Reprinted From: NuGen IT

The Geo Labor and Tax Rate (GLTR) Guide uses geopositioning technology to ensure

California Department of Insurance (CDI) regulatory compliance and

prevailing labor rate accuracy for the remaining 49 states

Lenexa, KS—December 4, 2018—NuGen IT has announced the release of its specialized Geo Labor and Tax Rate (GLTR) Guide to facilitate more efficient auto claims processing. The software application allows users immediate access to prevailing labor rate and tax information in a local market area for the repair estimate.

“NuGen IT’s comprehensive understanding of the department of insurance’s regulatory requirements for each state, combined with our claims expertise and advanced technology, have allowed us to develop the GLTR Guide, an innovative solution to further optimize the auto claims process,” said Pete Tagliapietra, NuGen IT’s business development leader. “The GLTR Guide will provide insurance companies access to the labor rate and tax information they need in real time, so they can accurately and efficiently write and/or finalize the repair estimate.”

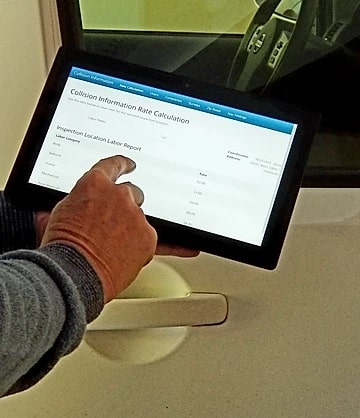

Users simply enable their location tracking or enter an address from any mobile device and the GLTR Guide has the capability to pinpoint the exact information in all 50 states using geopositioning technology.

“Insurance companies often don’t have the most up-to-date means to keep track of all the prevailing labor and tax rates across the country,” said Tagliapietra. “The GLTR Guide provides relevant information that is updated on a regular basis, so insurance carriers and collision repairs shops are assured of having access to the details they need.”

Also, the California Department of Insurance (CDI) established a standardized labor rate survey as part of its Fair Claims Settlement Practices Regulations. According to section 2695.81, the commissioner recommends insurers use the survey as a basis to settle or pay automobile repair insurance claims in a fair and equitable manner. If the insurer elects to use the survey, it must send a questionnaire to all auto body repair shops registered with, or licensed by, the Bureau of Automotive Repair (BAR) as an auto body and/or paint shop.

Based on the survey results, the regulation allows insurance companies to pay the prevailing rate based on a calculation or the shop’s asking rate.

NuGen IT has the infrastructure to conduct the survey for California body shops on behalf of an insurance company. After a survey is completed and the results are uploaded to the CDI website, an algorithm embedded into the software calculates the correct rates based on longitude and latitude. Appraisers can then realize the rates needed for the estimate.

“That’s a huge benefit to companies that do not have the resources to perform their own labor rate surveys,” said Tagliapietra.

The labor rates for all 50 states are updated monthly. The tax information is updated daily, providing state, county, municipal and specialized taxes by eight-digit zip code.

Because NuGen IT’s software uses geopositioning technology, the labor rate and tax information can be accessed by an insurance appraiser in the office on a desktop computer, as well as on a mobile device at the exact location.

“This gives appraisers the flexibility they often require to determine the rates no matter where they are located,” said Tagliapietra.

The software also allows an appraiser to print and/or electronically store a detailed PDF document with the name of the insurance company, the date and time the report was generated, as well as the longitude, latitude and address.

For more information about the GLTR Guide and to request a demonstration, contact [email protected]. Follow NuGen IT on LinkedIn and Twitter.

About NuGen IT

Established in 2004, NuGen IT develops and markets information management software tools and data-processing services to the property and casualty insurance industry and its stakeholders. NuGen IT is an employee-owned, privately-held corporation with offices in Nevada, Kansas and California. NuGen IT currently provides integrated auto and homeowners’ claims processing tools as well as collision repair workflow and business process compliance solutions in Canada, Europe and the United States.